The Misuse of ROI

Struggling to acquire new customers at scale? Learn more about how we've helped brands just like yours. Click here.

Scale and Diminishing Returns.

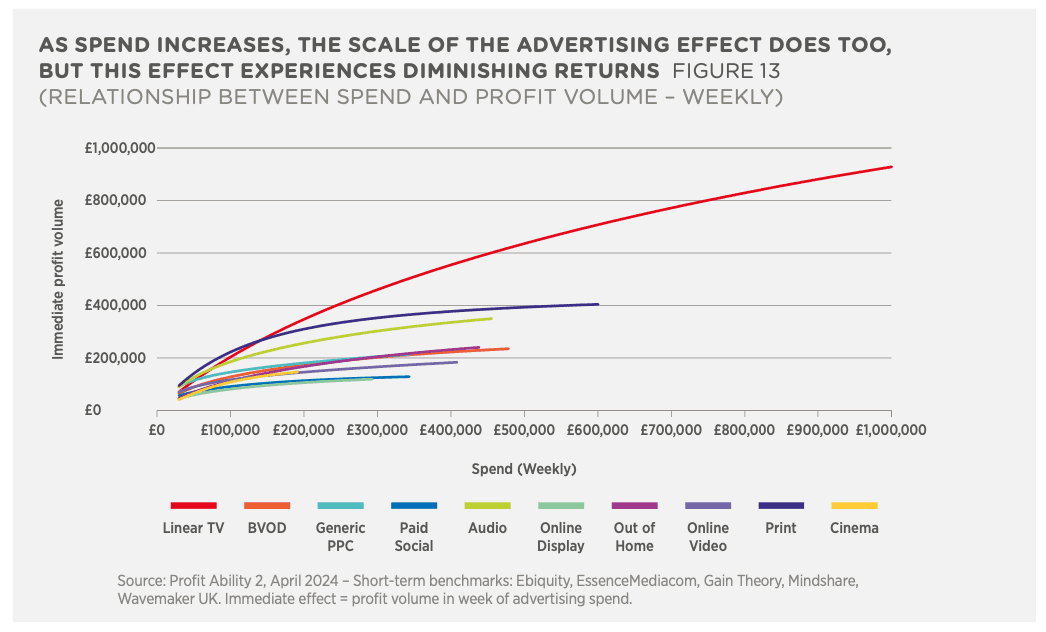

With the previous insight on profitability, scaling might seem straightforward; the more money we invest in advertising, the more sales and revenue we generate. However the relationship between spend and revenue is never linear. Another reason why we cannot isolate ROI as a measure of success.

As we increase our spending, especially on one specific channel, we eventually come across less and less new customers to reach. A higher investments in generating demand (upper funnel) is needed which does not reap immediate results. Consequently, each additional $1 spent has a progressively lower impact on revenue. This is known as Diminishing Returns.

The curve of Diminishing Returns varies hugely from channel to channel with some channels like Linear TV having a much higher ceiling than a channel like Cinema; as the below chart taken from Profitability 2, April 2024 shows.

Given the variation in diminishing returns across channels, budget allocation and most efficient channel mix will ultimately depend on your total budget size. This is where ROI can be an effective benchmark. Look at channels currently yielding higher ROIs and forecast the opportunities based on where you think the returns will start to diminish.

ROI Measures Efficiency.

ROI is great at measuring efficiency. Alone, its not a useful metric as simply reducing spend will increase ROI. But this will result in sacrificing scale. So by combining the idea of scale alongside efficiency (ROI) you have a good benchmark for success.

But what is classed as efficient? If we take Paid Social ads served through Meta, we would always work towards and ROI/ROAS of 3.

When we see campaigns or ads fall below this 3x threshold we can do 1 of 2 things. We can either reduce spend to bring this metric back up to 3 or we take a look at the effectiveness of the ads themselves and see whether there are optimisations we can make, without reducing budget, to make the campaign more effective. These optimisations could include removing poorer performing creative or testing new ad copy.

If we see campaigns or ads fly above that 3x benchmark, then it is an indication that there is more demand available and that budgets should be raised accordingly until we reach the 3x.

Of course, this benchmark will differ depending on AOV and the individual profit margins of each brand but generally speaking 3X is a good starting point.

This is a very dynamic way of working and means that budgets need to be flexible both within and across each channel. If you are currently working with strict and definite budget allocation, this could be a hinderance to growth. Take a look at where you might be able to make some changes to the way that spend is distributed to allow for these adjustments.